Today’s entry was written by Community Housing Network (CHN), one of our Equity Challenge Community Group Partner Organizations. Learn more about CHN at the bottom of this entry.

At the end of January last year, 653,104 people in the U.S. – or about 20 of every 10,000 people – were counted as homeless on a single night, according to the 2023 Annual Homeless Assessment Report by the U.S. Department of Housing and Urban Development (HUD). This figure, a 12 percent increase from 2022, is the highest since HUD began reporting on the issue to Congress in 2007.

A major cause? A lack of affordable housing, according to experts. Just 16 percent of homes for sale in 2023 were affordable for the typical U.S. household – the lowest share on record. That is down from 20.7 percent in 2022 and more than 40 percent before the pandemic homebuying boom.

Not only that, but reports show half of all U.S. renters have been cost burdened in the last two years, meaning they spent more than 30 percent of their income on rent and utilities. Today, only 37 affordable homes are available for every 100 extremely low-income renters. As a result, 70 percent of the lowest-wage households spend more than half their income on rent, placing them at high risk of homelessness when unexpected expenses (such as car repairs and medical bills) arise.

This affordable housing crisis that our nation is struggling with is compounded by the issue of closing the gap in homeownership rates among Black Americans, which has fallen behind since the financial crisis in 2008. According to the report, the gap between Black and white homeownership is now wider than it was more than 50 years ago, right before the 1968 Fair Housing Act was enacted to create equal housing opportunities for minorities, according to a report by the Urban Institute.

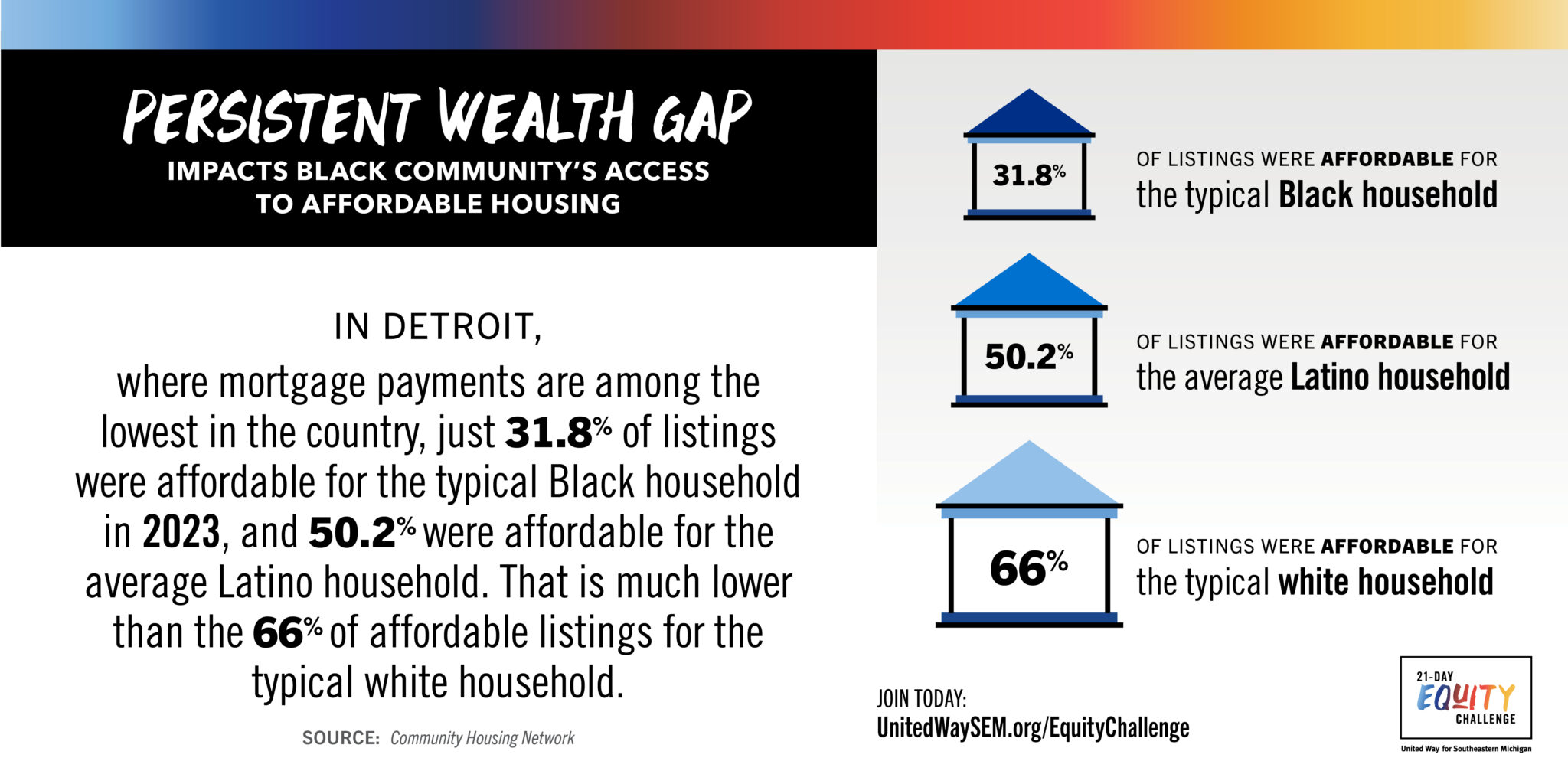

In Detroit, where mortgage payments are among the lowest in the country, just 31.8 percent of listings were affordable for the typical Black household in 2023, and 50.2 percent were affordable for the average Latino household. That is much lower than the 66 percent of affordable listings for the typical white household.

CHN is determined to help close the Black homeownership gap, which can impact the number of individuals experiencing homelessness, but we need your help to achieve this mission. We must work together to end racial housing discrimination that has been perpetuated for generations, along with hundreds of years of institutional racism, much of which still exists today.

Some examples of systematic housing discrimination:

Restrictive Housing Covenants: Although the Fair Housing Act of 1968 forbids all discrimination in housing, researchers point to the lingering effects of racially restrictive covenants that required home deeds in communities across the U.S. to include clauses that explicitly denied buyers based on race, ethnicity or religion. (History.com)

- A 2020 study by the Seattle Civil Rights & Labor History Project published ongoing research that so far found covenants covering more than 30,000 properties in Washington state, for example.

Secret Bias in Mortgage-Approval Algorithms: An investigation done by The Markup, and first reported by The Associated Press, found that algorithms lenders use to determine whether an applicant qualifies for a home mortgage have an inherent bias against minorities – mostly Black applicants – making their path to achieving homeownership and building wealth exponentially more difficult.

Predatory Lending: Predatory lending is an easily overlooked business that has damaged communities of color and low-income borrowers for decades. It traps them in never-ending cycles of debt with high-interest loans on coercive terms.

Changing the course of this entrenched problem will require intentional policymaking, an evidentiary foundation and effective partnerships at the national and local level between the many stakeholders in the housing ecosystem.

Bringing the rate of Black homeownership up to that of white Americans would require increasing the number of existing Black homeowners by 72 percent, or 5 million, according to a consortium of housing groups known as the Black Homeownership Collaborative, which aims to increase Black homeownership by three million households by 2030.

CHN builds affordable housing that is diverse and inclusive, where residents have access to opportunity and can be an integral part of the community. In addition to our efforts, learn more about what is happening in our state to address systemic racism and dismantle housing discrimination and segregation.

- The Michigan State Housing Development Authority (MSHDA) said they acknowledge that they must do better to increase Black homeownership and they will continue to invest in resources and advocate for policies that make homeownership attainable.

If you are facing a crisis that may put your current housing at risk, CHN may be able to help.

- Get Help on our website by completing the Housing Needs Information Request form.

- Leave us a message at 248-269-1335 or (toll-free) 1-866-282-3119.

- Text “housing” to 248-269-1335.

- Send an email to the Housing Resource Center.

- Contact United Way’s 2-1-1, a free service that connects Michigan residents with help and answers from thousands of health and human services agencies and resources right in their communities — quickly, easily and confidentially.

Today's Challenge

Read

- How the Racial Wealth Gap Has Evolved – and Why It Persists (15 minutes)

- Black Wealth is Increasing, But So is the Racial Wealth Gap (6 minutes)

- Examining the Black-White Wealth Gap (6 minutes)

Watch

- How Does the United States Tax System Systemically Punish Black Wealth? (18 minutes)

- Vox’s “Explained, the Racial Wealth Gap,” on Netflix (16 minutes)

Listen

- The State of Black Residents – The Relevance of Place to Racial Equity and Outcomes, a report by the McKinsey Institute for Black Economic Mobility. (32 minutes)

Engage

- Learn about things like fair housing and your rights, how to avoid predatory lending, how to determine what you can afford and more, by attending one of CHN’s Homebuyer Education, Rent Right Program, and/or Financial Education classes.

Act

- Get involved in your local community by advocating through organizations like the Michigan Coalition Against Homelessness (MCAH) or MSHDA.

- Join the National Low Income Housing Coalition (NLIHC) in their efforts to urge Congress to advance the equitable, anti-racist policies and large-scale, sustained investments needed to ensure renters with the lowest incomes have an affordable place to call home.

- Habitat for Humanity offers up “5 Policy Solutions to Advance Racial Equity in Housing” to be informed about. Get advocacy opportunities right to your inbox and make an impact on the urgent need for affordable housing.

- Spend time volunteering with community organizations like CHN that work in housing.

Reflect And Share

- Considering your personal privileges and knowledge of the barriers to housing that exist, what does affordable housing mean to you?

- What can you do to empower or support communities with education, opportunities and a vision for wealth-building that can pave the way to closing the wealth gap?

- Are you aware of local housing resources to help support someone experiencing a housing crisis or housing instability?