Earned Income Tax Credit

Don’t Miss Out on Thousands of Dollars! Claim What You Are Owed.

The Earned Income Tax Credit (EITC) provides a tax credit to working people with low to moderate income. Qualifying individuals receive a cash payment (via direct deposit or paper check) after filing their taxes. The IRS starts sending refunds in mid-February. By law, the IRS is not allowed to send EITC refunds during the first few weeks of tax season.

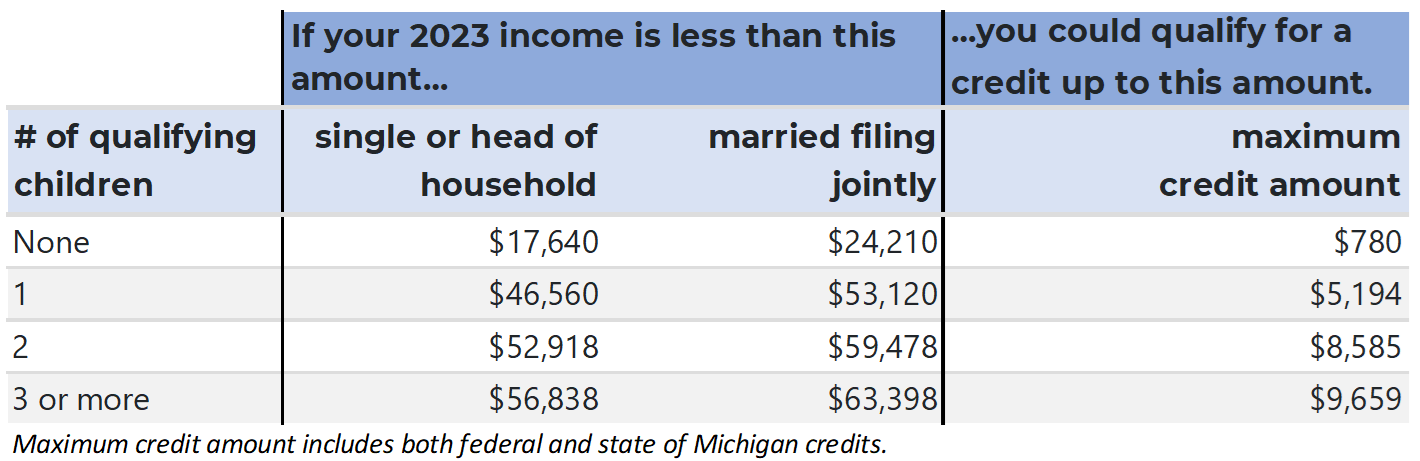

In addition to the EITC credit from the federal government, Michigan now offers an expanded state EITC credit. This means more money in your pocket if you qualify!

To claim your credit, you must file a tax return, even if you do not owe any tax or are not otherwise required to file. If you worked full or part time in 2023, you may qualify for the credit.

You must have earned income (from working) in 2023 to qualify. If you have some earned income, you can qualify even if you receive other benefits. The details vary depending on your tax filing status and number of children in your household. All of the adults and children on your tax return must have a Social Security Number for your household to qualify.

Qualifying children can include your biological children, adopted children, grandchildren, younger siblings, and nieces and nephews. To qualify, children must live with you at least half of the year and be under age 19, be under 24 and a full time student, or be permanently disabled.

Get The Tax Facts is made possible thanks to the support of a coalition of partners and funders.