Coalition urges Detroiters to claim Earned Income Tax Credit and explains the latest on Child Tax Credit for 2022

- Detroiters received thousands in tax credits through both programs last year

- How much could your family receive this year? File your taxes now to find out!

- Hundreds of volunteers and staff will offer free tax preparation, including Drop & Go locations

- All the information you need available at www.getthetaxfacts.org

DETROIT, January 31st, 2022 – The City of Detroit is working with several organizations to continue its annual push to encourage Detroiters to file their taxes and claim their refunds. This year, with both the expanded Child Tax Credit and the increased refunds from the State of Michigan Earned Income Tax Credit, filing your taxes is even more important.

Mayor Mike Duggan, joined by Accounting Aid Society, United Way for Southeastern Michigan, Wayne Metropolitan Community Action Agency, University of Michigan’s Poverty Solutions and Community Development Advocates of Detroit, kicked off the 2022 income tax season today and outlined efforts to urge residents to claim their credits.

“The City of Detroit and its partners are going to make sure every Detroiter has the help and information they need to claim these funds,” said Mayor Mike Duggan. “The expanded Child Tax Credit is a once-in-a-lifetime opportunity we don’t want you to miss out on.”

You can’t take advantage of these credits and boost your bank account if you don’t file your taxes. In most cases, you can file your taxes for free in Detroit, thanks to the help of hundreds of staff and volunteers from Accounting Aid Society and Wayne Metro who will assist with tax preparation in person, virtually, and at “drop & go” locations. Through the generosity of partners at the Skillman Foundation, Kresge Foundation, Ballmer Group, and W.K Kellogg Foundation these efforts will receive additional support this year.

As a result of the City of Detroit’s annual EITC campaign, Detroiters have claimed $56 million more in EITC refunds each year on average. Prior to 2017, EITC-eligible Detroiters left an estimated $80 million of potential tax refunds unclaimed each year.

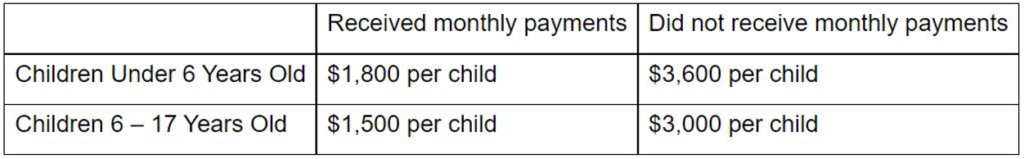

Through last year’s coordinated outreach in the City of Detroit, thousands of Detroit families were able to take advantage of the expanded Child Tax Credit. Many of these families received monthly payments of up to $300 per child. Families are eligible for an additional lump sum of up to $1,800 per child when they file their taxes in 2022, plus any of the monthly payments they may have missed.

“Over the past six months, the expanded monthly Child Tax Credit has helped thousands of Detroit families pay for food, school supplies, and other necessities — and parents still get the other half of that credit, plus others, when they file their taxes! We need to ensure all eligible Detroit families file taxes to claim these credits, so they can continue to receive this critical support,” said Luke Shaefer, director of University of Michigan’s Poverty Solutions initiative and the Hermann and Amalie Kohn Professor of Social Justice and Social Policy.

CHILD TAX CREDIT:

If you have children under 18 in your home, you were eligible for monthly cash payments that began in July 2021 through the expanded Child Tax Credit, but you must file taxes in 2022 to receive the second half of your credit.

If you received any Child Tax Credit payments last year, be on the lookout for a letter from the IRS detailing how much you received. You will need this letter to file your 2022 taxes and ensure you get the maximum allowed payment. If you don’t supply this letter with your tax filing, your 2022 payments could be withheld.

If you didn’t receive any monthly payments in 2021, it’s not too late to claim your Child Tax Credit. You may be eligible even if you are not the child’s biological parent, do not usually file taxes or have low/no earnings.

EARNED INCOME TAX CREDIT:

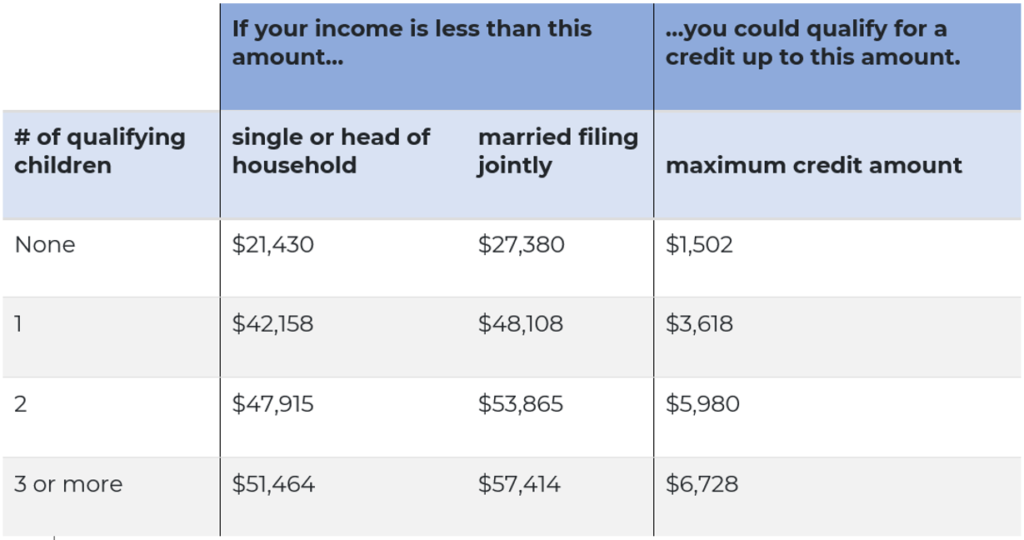

The EITC is available to working families and individuals who meet certain income requirements. The amount of the refund depends on income, filing status, and number of qualifying children claimed on tax returns. For example, a single individual with no children who works and makes less than $21,430 could get back as much as $1,502. A married couple with three or more children who files a joint return, with a combined income of less than $57,414, could receive the maximum EITC of $6,728.

If you worked at all in 2021, you may be eligible for the Earned Income Tax Credit. The Earned Income Tax Credit provides extra income to workers with low to moderate incomes, up to $57,000. Changes to tax law mean that more workers are eligible now than ever before.

FREE TAX PREP AVAILABLE:

“Accounting Aid Society recognizes that families and individuals in our community want accessibility, flexibility, and safety. Our in-person, virtual, and drop-and-go tax filing options provide just that, allowing clients to fit tax preparation into their schedules and providing assistance for those without an existing tax site in their neighborhood. After a hard stop in March of 2020, in-person tax preparation is back at five locations across Detroit, providing the dependable service our clients deserve,” said Priscill Perkins, President and CEO of Accounting Aid Society. “With drop-and-go, clients leave their documents with a tax preparer, and are able to review their completed return about a week later, while our secure virtual tax preparation lets clients use smartphones, tablets, or a computer’s camera to upload and sign documents, all without leaving their homes. All our options are free to qualified households. Additionally, we are adding the support of our Low-Income Taxpayer Clinic to our existing locations to help clients resolve issues with the IRS. As we continue to navigate the changing landscape of the pandemic, along with the uncertainties of an economy that has been brutal to our community, Accounting Aid Society will provide professional, reliable services to our clients, as we have for the last 50 years.”

“This tax season, we continue to utilize several different strategies to safely complete tax returns to meet the need for families to help them gain access to much-needed resources such as the CTC and EITC,” said Louis Piszker, Chief Executive Officer of Wayne Metropolitan Community Action Agency. “All clients begin the tax prep process with over-the-phone intake. From there, we work with the client to determine whether the remainder of the tax filing process will be completed virtually or in person, based on client preference. We continue to balance service and safety with Wayne Metro sites remaining open to help meet the community needs.”

Through its extensive network of community resources, United Way will lead this coalition – making sure Detroiters are connected to the help they need.

“Even in good times, we clearly need to do more to support working households, but in these challenging economic times, it is absolutely vital. Both the Child Tax Credit and the EITC help working families make ends meet. For many, these important tax benefits can be the difference between financial stability and crisis. However, too many people are unaware that they are eligible,” said Dr. Darienne Hudson, president, and CEO, United Way for Southeastern Michigan. “We’re proud of this partnership with the City, Accounting Aid Society, Wayne Metro, and others to help ensure everyone has the opportunity to boost their incomes by securing these credits, especially for those hardest hit by the pandemic. We know the EITC and Child Tax Credits are among the most effective tools we have to lift families out of poverty and put them on the path to stability, and we are encouraged that the legislature and Governor Whitmer will consider providing even more relief to Michigan workers by increasing the state EITC.”

Make an appointment for tax help today by calling 2-1-1 or going online at GetTheTaxFacts.org

###